How Long Do You Have to Wait to File a Chapter 13 Again

Dealing with immense debt or a financial emergency can occur more than in one case in your life. While it'southward often possible to rebuild credit after defalcation , filing for bankruptcy once again is sometimes the all-time remedy. When facing such troubled times, bankruptcy may exist the best remedy.

While at that place is no limit to how many times you tin file bankruptcy , at that place are limits on how frequently you lot tin file. If y'all've had debts discharged in a bankruptcy, there'southward a waiting period that'southward based on when you filed that previous bankruptcy.

Nerdy tip: The courtroom "discharges" your example when yous've satisfied the weather of the bankruptcy. Information technology releases you from obligation to repay the debts included in your defalcation and protects y'all from creditor collection efforts on them.

If you're considering filing again, first respond these questions:

-

Did your most recent bankruptcy finish in a discharge?

-

What was the filing engagement for that bankruptcy?

Here are some scenarios for discharged bankruptcies and how long yous'll need to wait to file again.

Filing Chapter seven after a Chapter 7 discharge: 8 years

If you had a Affiliate vii that resulted in discharge of your debts, you must wait at least eight years from the appointment you lot filed it before filing Chapter 7 defalcation again.

While Chapter 7 is typically the quickest form of debt relief, the eight-year period to refile is the longest waiting time between cases.

Filing Chapter 13 afterward a Affiliate 13 discharge: 2 years

If you lot had a Chapter 13 bankruptcy discharge and are looking to file again, you must wait two years from the previous filing date.

While this is the shortest time allowed between any two filings, it is as well the rarest sequence considering a Affiliate 13 restructuring typically takes three or v years to repay. But a Chapter 13 can sometimes be discharged early on due to additional extreme hardship.

Filing Chapter 7 later on a Chapter 13 belch: half-dozen years

After a Chapter xiii discharge, the standard waiting time before yous can file Affiliate 7 is six years from the previous filing date.

The six-year wait can be waived if yous paid your unsecured debts in full in your original Affiliate xiii case or if you paid at to the lowest degree lxx%, your program was made in proficient faith and y'all fabricated your best effort to repay.

Filing Affiliate 13 after a Affiliate 7 discharge: 4 years

Afterwards a Affiliate 7 discharge, you must wait a minimum of four years from its filing appointment before yous can open some other case.

You may exist able to avoid the four-year wait and file Chapter 13 immediately with the caveat that your new Chapter 13 cannot exist discharged. You might want to do this to ready a payment plan for debt yous couldn't wipe out in your Chapter seven. When yous follow a Chapter 7 with a 13 in gild to handle remaining debts under a payment plan, information technology's sometimes nicknamed a "Chapter 20."

What if my previous case wasn't discharged?

Sometimes the defalcation court dismisses or ends a case without a discharge. That could happen if you failed to appear in court, ignored a court society or voluntarily dismissed your ain example considering a creditor filed a motion to go along collection efforts. If your case was dismissed, yous have to wait 180 days to file over again. Note that subsequent filings might not earn you the automatic stay of drove, repossession and foreclosure actions. So you may not be equally shielded from creditors pursuing payment.

In other instances, courts tin deny the discharge of your debts in a bankruptcy. Reasons for denial include failure to provide documents, hiding assets or perjury.

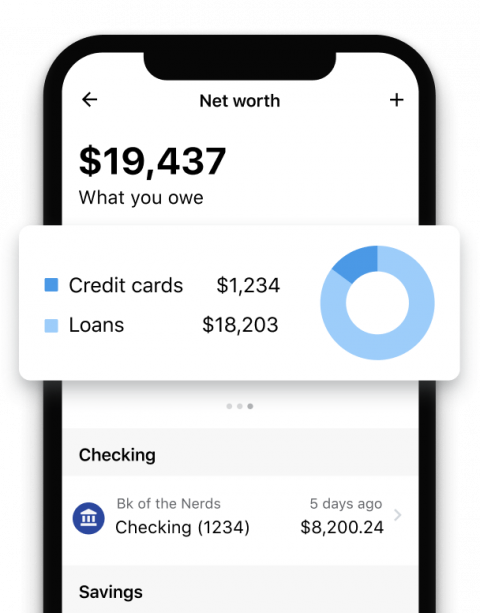

Watch your debts dwindle

Sign upwards for an account to link your cards, loans and accounts to manage them all in 1 place.

Get the assistance you lot demand

The bankruptcy process can be a daunting i. Hiring a qualified bankruptcy attorney to guide you through it is generally recommended to ensure a successful filing, and you'll accept to consummate mandatory bankruptcy counseling . Making a mistake with forms or overlooking a deadline could atomic number 82 to your case being thrown out, setting back your progress.

mccrackenmashe1968.blogspot.com

Source: https://www.nerdwallet.com/article/finance/how-often-can-you-file-bankruptcy